Embraer’s chief executive, Francisco Gomes Neto, told the Financial Times that surging demand for new aircraft over the next two decades creates a market large enough for more than Boeing and Airbus, opening the possibility that new entrants could erode the long-standing duopoly. Gomes Neto said Embraer will focus on strengthening its regional-jet franchise while watching the competitive landscape evolve.

The comments, reported by the FT and summarised by market outlets, arrive amid wider industry shifts: rising narrow-body demand, supply-chain constraints and geopolitical trade tensions (including tariff threats). Embraer balances ambition with prudence: management reiterated revenue and delivery targets while stopping short of committing to a new large single-aisle programme.

Why Embraer thinks the duopoly can be challenged

Embraer’s argument rests on market scale. Industry forecasts point to tens of thousands of aircraft needed over the next 20 years as air travel grows in Asia, Africa and Latin America. Gomes Neto told FT that this volume could support three or four major narrow-body manufacturers, not just two, a structural change that would lower barriers for challengers if they can meet certification, financing and support requirements.

Support for the view comes from several trends:

- Huge demand pools in Asia and Africa that require lower-cost, efficient single-aisles and regional jets.

- New OEM entrants such as China’s COMAC (C919) are already targeting the narrow-body market.

- Aftermarket growth and services expansion stretch the industrial ecosystem beyond OEMs — creating commercial room for new players.

Embraer’s strategy: grow regionals, avoid overreach

Gomes Neto emphasised Embraer’s current playbook: double down on the regional-jet market (E2 family), accelerate service revenue and maintain financial discipline. He explicitly ruled out rash moves into large single-aisle programmes for now, citing the massive R&D and certification costs such programmes demand. Instead, Embraer plans incremental growth: increase E-series sales, explore military and aftermarket opportunities, and pursue partnerships that would de-risk any future step up.

This is a conservative choice: developing a competitor to the A320/737 families requires sustained capital, global supply chains and regulatory acceptance, a combination few new entrants have managed to secure quickly. Embraer’s track record in regional jets and its KC-390 military transport provide credibility, but scaling to high-volume narrow-body production is a different industrial problem.

Industry context and regulatory hurdles

Any credible challenger must clear major obstacles:

- Certification: International acceptance (EASA, FAA) is a precondition for global sales. COMAC’s C919 experience shows certification can take years beyond domestic approvals.

- Supply chain & tariffs: Embraer itself warned of tariff risks, U.S. import taxes or geopolitical trade measures can dramatically raise costs for OEMs that rely on cross-border parts. Management has flagged these headwinds in recent months.

- Scale & financing: OEMs need multi-billion-dollar investments and a committed launch customer base to justify program launch. That requirement remains a high bar for new entrants.

Timeline & key facts

- FT interview published Oct 2025; Embraer CEO outlines strategic view.

- Embraer projects growth targets (delivery and revenue guidance) toward the end of the decade; treat as company guidance.

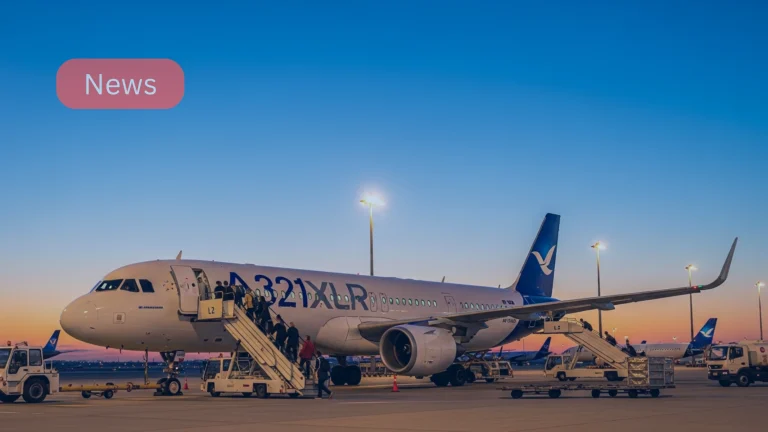

- Industry signals: Airbus A320 family recent delivery milestones and aftermarket growth underline the market scale.

What this means for airlines, suppliers and investors

- Airlines gain leverage as more OEMs could mean better pricing and wider configuration choices.

- Suppliers face both opportunity (more platforms) and risk (fragmentation, more competing standards).

- Investors should watch Embraer’s execution on deliveries and service expansion, management guidance matters but must be validated by order books and audited results.

What’s next? Industry outlook

- Watch for deliverables: See whether Embraer hits its stated delivery/revenue targets through 2028; that will be an early litmus test of its growth thesis.

- Monitor challengers: COMAC’s certification progress and any announcements from established players eyeing narrow-body moves will be key indicators.

- Regulatory signals: EASA/FAA statements on third-party certification and any tariff developments (notably U.S. policy on Brazilian imports) will materially affect competitive dynamics.

Sources & further reading

- Financial Times, Embraer predicts challenge to Boeing and Airbus duopoly, Sylvia Pfeifer / FT, Oct 2025.

- TradingView / Reuters summary of FT reporting.

- AirDataNews, coverage of Embraer CEO interview and company guidance.

- Reuters, Airbus/A320 delivery and aftermarket context.