Airbus announced that Vietnamese low-cost carrier VietJet has finalised an order for 100 A321neo single-aisle jets, the largest individual order reported for Airbus in 2025, following an MoU signed at the Paris Air Show. The memorandum was signed in June and the formalization of the deal was reported publicly in October/November.

The order arrives as Airbus disclosed robust October activity: 78 aircraft delivered in October, and 585 deliveries year-to-date, keeping the manufacturer on track, though still requiring an accelerated output in November-December to meet its 2025 target of 820 deliveries. Industry sources say the VietJet deal and October delivery surge spotlight both demand strength and the production pressures Airbus faces.

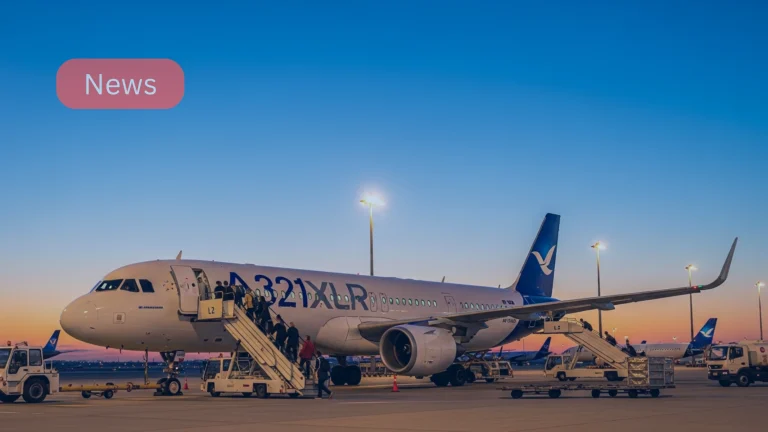

Airbus largest aircraft order 2025, what happened and why it matters

The VietJet commitment for 100 A321neo jets (with options reported in the MoU for additional airframes) is the headline commercial win for Airbus this year and was highlighted as the company’s largest order of 2025 by regional press. The A321neo, the stretched, long-range member of the A320neo family, remains the best seller in single-aisle markets and suits VietJet’s network expansion plans across Southeast Asia and beyond.

Airbus’ October performance, 78 deliveries to 36 customers, helped lift its YTD deliveries to 585 aircraft, according to the manufacturer’s Orders & Deliveries summary, a key metric investors and carriers watch to gauge factory output and backlog health. To hit the company’s 820 deliveries guidance for 2025, Airbus would need to deliver roughly 235 aircraft across November and December, a steep ramp that industry analysts say will challenge supply-chain and production capacity.

Timeline

- MoU signed at Paris Air Show: June 2025.

- Order finalised / publicly reported: late October – early November 2025.

- Airbus October 2025 deliveries: 78 aircraft (36 customers).

- Airbus YTD 2025 deliveries after October: 585.

Commercial context: Why VietJet picked the A321neo

- Unit economics & range: The A321neo provides low per-seat fuel burn on medium- and longer-thin routes, attractive for growing LCCs pursuing regional and near-long haul expansion.

- Fleet commonality: VietJet already operates predominantly Airbus narrowbodies, making fleet commonality (training, spares, operations) a strong operational case. Reuters and Airbus note Airbus’ strong market share in Vietnam.

Production and delivery pressure, what Airbus faces

Airbus’ backlog remains large; while orders continue, converting those into timely deliveries requires supplier coordination, labour, and factory throughput. The manufacturer’s own figures show strong monthly delivery spikes but also underline how much remains to be delivered to meet its annual target. Analysts caution that achieving 235 aircraft in two months is ambitious and depends on smoothing any remaining supply-chain pinch points.

Industry reaction and likely downstream effects

- For VietJet: The order accelerates network growth plans and leasing/financing requirements; it also signals ambition to capture intra-Asia and secondary long-haul leisure markets.

- For Airbus: The deal helps maintain sales momentum established at the Paris Air Show and supports the A320neo family’s dominance, but also increases near-term pressure to deliver and to manage supplier commitments.

Regulation, financing, and delivery scheduling

Large aircraft deals include complex financing, engine selections and aftermarket services (maintenance, spare pools). Airbus’ press releases and industry reporting indicate such deals often come with engine and services packages (some reports link Rolls-Royce engine agreements in related VietJet announcements), though specifics vary and are confirmed in manufacturer/airline statements. Readers should consult OEM and airline notices for firm pricing and delivery schedules.

What’s next? Industry outlook

- Airbus will aim to sustain monthly delivery volumes and convert gross orders into firm purchase agreements. The market will watch November and December output closely, hitting the 820 target hinges on factory ramp and supplier delivery reliability.

- VietJet’s fleet expansion, if financed and executed on schedule, could reshape point-to-point capacity across Southeast Asia and into nearby long-haul leisure markets.

Sources and further reading

- The Peninsula / QNA, Airbus announces largest aircraft order of year. (07 Nov 2025).

- Airbus press releases, VietJet to order 100 Airbus A321neo and Airbus Orders & Deliveries (June & October 2025).

- Reuters, Vietnamese airline Vietjet orders 100 Airbus jets (Oct/Nov 2025).

- Industry analysis (SimpleFlying / Aerotime), coverage of October deliveries and production context.