General Electric’s GE9X, the largest commercial jet engine ever built, is drawing industry attention not only for its groundbreaking scale but also for growing concerns over performance durability and market dynamics, according to a new analysis by Peter Hanson at Simple Flying, published on August, 2025.

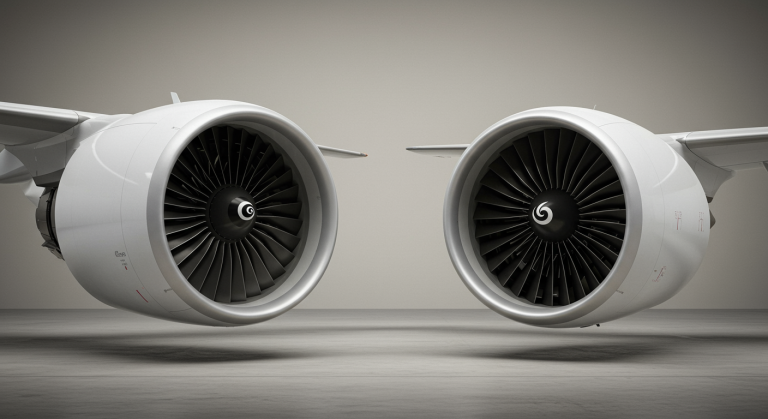

At a fan diameter of 134 inches, the GE9X eclipse engines like Rolls‑Royce’s Trent and Pratt & Whitney’s geared turbofans, and officially delivers up to 105,000 lb of thrust, with test capability reaching 134,000 lb. This unprecedented size positions the engine to power the long-delayed Boeing 777X, but also raises engineering and market challenges.

Scale Meets Skepticism: Why the Engine Is Causing Pause

Hanson’s piece argues that GE’s strategic positioning must balance ambition with reliability. While the GE9X promises improved fuel economy and ultra-high thrust, its novel engineering entails pushing new materials and cooling architectures, which historically can shorten time‑on‑wing durability, a concern echoed by Lufthansa CTO Grazia Vittadini regarding next-gen engine wear-out patterns.

Simple Flying also points out that competitors such as Pratt & Whitney’s PW1000G series and Rolls‑Royce’s Trent 1000 have already experienced notable reliability challenges in service. By spotlighting these trends, the article suggests GE must ensure the GE9X avoids similar early-life issues.

Market Pressures on the GE Side

For GE, the GE9X represents not only a technical milestone but also a commercial necessity to support Boeing’s 777X program, which has faced numerous delays. With airlines increasingly demanding lower emissions and longer maintenance intervals, any reliability hiccup could magnify financial and reputational risks, especially as GE’s joint venture CFM International continues deploying LEAP engines across narrowbody fleets.

Where Evidence Falls Short

While Hanson’s narrative is plausible, the article lacks hard confirmation:

- No direct comments from GE Aerospace executives or Boeing testing personnel are provided.

- There’s no citation of test data, failure case logs, or regulatory filings such as FAA/EASA certification findings.

- The framing of “why GE should be worried” remains speculative without explicit documentation of GE deducing internal performance shortfalls.

Cross-Checks with Industry Signals

Reports from Reuters and aviation-focused outlets affirm airlines like Lufthansa have stressed the importance of durability over mere efficiency. They warn that newer high-bypass and geared turbofan engines have prompted maintenance bottlenecks during recent years.

Meanwhile, historical context confirms GE9X has paused Boeing 777X test flight operations in early testing after bore-scope observations during thermal stress trials, a sign that even high-profile development programs face iterative engineering corrections.

Implications for Market Dynamics

If durability concerns materialize, such as unplanned in-service removals or accelerated degradation, the ripple effects could impact:

- Certification timelines for the Boeing 777X, especially with major customers like Emirates scheduled for first deliveries starting in 2026–27.

- The competitive edge of GE versus Rolls‑Royce and Pratt & Whitney, particularly on long-haul platforms.

- Airlines’ confidence in engine leasing pools and long-term maintenance planning, given the high cost and limited supply of GE9X units.

Looking Ahead

Hanson advocates vigilance: while the GE9X certainly showcases a milestone in turbofan scale, energy density, and fuel performance, GE must now demonstrate that durability and operational reliability keep pace. Independent third-party test data, maintenance records, or regulatory filings (such as FAA/EASA notes), would significantly strengthen future reporting on this topic.

Bottom Line

- The Simple Flying article brings attention to valid industry concerns: engine durability under increasingly ambitious power and efficiency goals.

- It’s balanced in tone and contextualizes GE within a competitive propulsion landscape.

- But it remains hypothesis-driven: lacks internal evidence or third-party confirmations.

- Readers should monitor official test reports, certification disclosures, and operator feedback as the GE9X enters service.

Citation Note

This article is based primarily on reporting from Simple Flying, authored by Peter Hanson, titled “Why The World’s Largest Aircraft Engine Has GE Worried”, published in August 2025.

Additional context and corroborating information were drawn from the following sources:

- GE Aerospace official site: Technical specifications and production updates on the GE9X (geaerospace.com).

- FlightGlobal and Wired: Engine size and thrust comparisons.

- Reuters: Comments by Lufthansa CTO on engine maintenance trends.

- Wikipedia: Background details on GE engine families (GE90, CF6, LEAP).

All interpretations, summaries, and extrapolations are journalistic in nature and reflect the current status of available public reporting as of August 2025.