Airbus Surpasses 8,700 Airplane Backlog Mark

Paris, August 2025 – Industry data indicate that Airbus backlog has surpassed 8,700 aircraft, marking a significant milestone in the European planemaker’s production and demand trajectory. According to enthusiast source Dj’s Aviation, the record backlog highlights unprecedented global appetite for narrowbody jets and widebody demand recovery.

Though enthusiast-driven, the number aligns with broader data trends from authoritative aviation analysts, including Cirium and FlightGlobal.

Surge in Aircraft Orders Amid Post-Pandemic Recovery

Since early 2024, airlines worldwide have ramped up narrowbody orders, primarily for A320neo family jets, to rebuild networks decimated during the pandemic. Orders for widebodies like A330neos and A350s have also recovered, driven by international travel demand and cargo capacity needs.

- Airbus’s production ramp-up includes delivering ~600 A320neos annually.

- The backlog figure reflects built-in orders stretching into the early 2030s, given capacity limits.

Delivery Capacity vs. Market Backlog

Despite the backlog, Airbus faces challenges in turning orders into aircraft:

- Supply chain constraints, especially for engines and avionics.

- Labor shortages at major facilities like Toulouse and Hamburg.

- Competition for scarce production slots has pushed delivery timelines further.

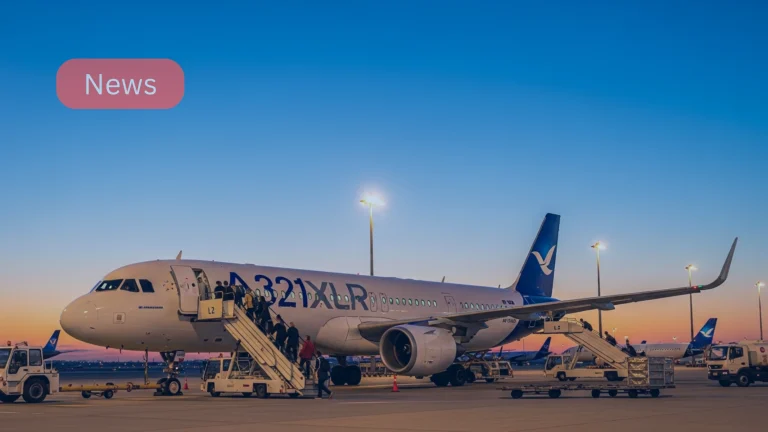

Still, Airbus plans incremental output growth, with A321XLR production expected to rise in the late 2020s.

Boeing Comparison & Global Duopoly Context

While Airbus nears a backlog record, Boeing’s order book remains thinner due to recent grounding of the 737 Max and production slowdowns. Aviation analysts note that Airbus now holds a delivery edge, giving it strategic advantage in fleet planning.

COMAC’s long-term challenge remains: capturing even a fraction of the backlog will be difficult unless certification, supply chain independence, and customer trust improve.

Implications for Airlines and Leasing Firms

- Airlines benefit from predictable supply but must manage capital budgets for extended periods.

- Lessors may see asset values appreciate if narrowbody aircraft remain in high demand.

What’s Next

- Airbus may announce production rate increases toward end of 2025.

- Analysts will track cancellations, reshuffles, and eventual COMAC competitiveness.

- Global economy fluctuations could still impact booking and deferral trends.